Q1 2025 Quarterly Newsletter: "Multifamily Spring"

Q1'25 State of the Market: "Multifamily Spring"

Written by SPI Co-Founder & Principal, Michael Becker

Q1 2025 Newsletter

Hi, Michael Becker Here...

In this newsletter, I will discuss what I foresee for Texas multifamily now that it’s spring and with summer just around the corner.

In the Q4 2024 Newsletter, I noted that I expected multifamily sales activity to increase throughout 2025, following low sales numbers in both 2023 and 2024. I also mentioned that institutional equity is becoming bullish on future rent growth due to our industry being past “peak supply” as we entered 2025, setting up for two low supply years in 2026 and 2027. Construction costs remain elevated, and with the recent on-again, off-again nature of looming tariffs, new multifamily development deals are becoming increasingly difficult to pencil, further pushing out the date for the next wave of new deliveries. All of this appears to be playing out in real time now that we are a quarter deep into 2025.

Below are some additional observations I made through the first quarter of 2025:

- Newer vintage assets are performing better than older vintage assets from an operational standpoint. We are starting to see rents recover better on the nicer deals (largely due to less competition from new deliveries), while older assets are still a bit more challenged from a revenue standpoint. The average workforce tenant appears to be stretched financially, and bad debt levels remain elevated compared to historic norms.

- The market is at the beginning of its recovery after two challenging years operationally. I expect the recovery to be more robust on the newer vintage deals and more disparate on the older vintage workforce deals. The condition, location, and quality of your neighbors vary much more in the workforce space, leading to a wider range of outcomes in this subset of properties. In particular, if you have neighboring properties owned by a group in the process of losing their deal to the bank, they tend to let unqualified tenants live there, which leads to both lower rents and higher crime in the submarket, impacting neighboring properties' operations. Additionally, I am hearing stories that the new Trump Administration’s crackdown on immigration is starting to affect certain neighborhoods more than others. As a result, the recovery will be much choppier in the workforce housing space. We are always exploring opportunities in this space, but properly evaluating the micro-location is of the utmost importance, especially in the current environment.

- In Texas, for the first time in a long time, Houston appears to be the strongest from a fundamental standpoint among the four major Texas markets. This is due to Houston seeing less new supply starts in 2021-2023 relative to the other markets. This year and next year should be Houston’s two good years out of the next ten before something happens like a hurricane or a locust plague, reminding everyone that Houston still sucks and is cheaper than Dallas for a good reason. North Texas (DFW) is recovering better in real time compared to Central Texas (Austin and San Antonio). I expect Central Texas to be about six to nine months behind North Texas due to the larger percentage of new supply still being delivered. While slower than we all would like, both markets appear to be heading in the right direction in real time. My crystal ball says this becomes evident in the reported metrics from companies like RealPage and CoStar in the coming quarters when they are looking backwards.

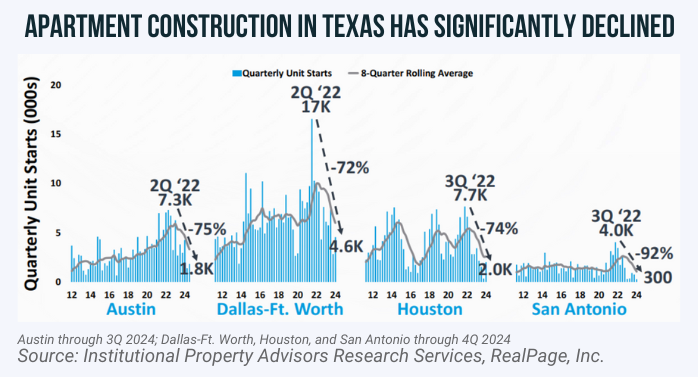

- I have been saying for well over a year now that I expect both 2026 and 2027 to be two great years for our industry. It has been extremely hard to capitalize on a new multifamily development deal ever since the failures of First Republic and Silicon Valley Bank in March 2023. The time it takes to build a multifamily property in Texas, from breaking ground to leasing units, is about 24 months on a garden-style deal and about 30 months for your average wrap construction deal. My conviction in that outlook continues to grow by the day. I recently saw the chart below at an IPA-sponsored event. It shows the dramatic decline from the peak quarter for multifamily unit starts compared to Q4 2024. You can see all the Texas markets have significantly lower starts, which, if you fast-forward two years, means there will be significantlylower deliveries compared to today. San Antonio has virtually no new starts. In Q4 2024, the entire market had one 300-unit project break ground in a market with over 220,000 units. Until rents materially rise and/or construction costs materially decline, there will be exceptionally low new construction for the foreseeable future. The law of supply and demand dictates that, if there is no supply, renters will eventually have to pay higher rents for the existing limited supply of units.

- Some multifamily property owners are approaching their limits. Deals put together at peak pricing in 2021 and 2022 with bridge loans are starting to see their loans mature, forcing tough decisions to either cash-in refinance or sell at a loss. There was a recent post-NMHC Conference surge of listings starting mid-February in DFW and San Antonio with a bunch of workforce housing deals. My observation is that most of those listings have optimistic pricing guidance essentially at their debt basis plus closing costs — basically the sponsors are trying to avoid foreclosure. Those deals are calling for offers right at the end of March. It will be interesting to see how many get offers high enough to clear their debt. I suspect the majority won’t, and then we will see what the lenders and borrowers do once that price discovery happens and it’s below their debt basis. To date, lenders have not been willing to take losses by and large, so we will see if that changes and they decide to pursue foreclosures, or if they continue to "extend and pretend." There haven't been many newer vintage deals showing stress, but some might need to clear the market by summer's end. I’ll update everyone on what I see in my Q2 2025 newsletter article. My prediction is that this is the moment workforce housing values reset downward as lower values become market-wide consensus.

- In both Austin and DFW, we are seeing more two- and three-letter institutions in the market bidding on new Class A deals in top-flight submarkets. This is happening on a greater scale in DFW, as Austin is still slow from a transactional standpoint. I am hearing of a few large price-per-unit trades about to happen in Austin. The newer vintage values that have traded recently are at quite a lower value in Austin compared to the peak (similar but to a much lesser extent in DFW, as DFW has held up better than Austin). This is causing current owners in Austin not to sell unless forced. As I noted previously, values are beginning to recover in real time, but there is still a window open to buy deals at a compelling value below replacement cost. That window is beginning to close, so we will see how long it stays open for groups like SPI to take advantage of. I suspect that when the data services confirm, looking in the rear-view mirror over the upcoming quarters, that rent growth is back in DFW/Austin, values will gap upwards quickly. In the following slide, you can see that IPA and RealPage expect rent growth to be positive in all four Texas majors by year-end 2025, so it’s my opinion that the window is closing on the best opportunities as we speak.

In conclusion, it is still a bit difficult out there with various challenges we all deal with day in and day out. However, we are seeing green shoots all around; multifamily spring is here. As I noted in my Q4 article, it is not going to be a direct path from spring to summer, but we are improving week in and week out, and the challenges of multifamily winter fade away as the days get longer.

We at SPI are doing our best to identify as many quality and actionable opportunities as we can while the window is open to buy quality deals below replacement cost, especially in the Austin MSA, which has been very slim pickings recently. That is easier said than done. We appreciate any deal we can secure today, as things are still challenging. I feel fortunate to have been able to get more done than most of our peers who are dealing with more issues than us (not saying we are not dealing with issues, just in smaller numbers and scale than many of our peers). Soon enough, they will overcome these challenges and join us back on the battlefield. Until then, we hope to offer a few opportunities for investment before 2025 is over. If you’d like to be the first to know when our next 506(c) Offering becomes available, apply to join our database, if you haven't already.

Cheers,