Q1 2024: Industry Spotlight - JP Conklin

Industry Spotlight: JP Conklin

Written by Michael Becker, Principal & Lily Turner, Marketing Manager

Q1 2024 Newsletter

JP CONKLIN | Founder & President, Pensford Financial Group & LoanBoss, Inc.

JP Conklin

is the Founder and President of Pensford Financial Group, the esteemed commercial real estate interest rate advisory firm, and the equally notable commercial real estate debt management software company, LoanBoss, Inc. JP obtained his Bachelor’s degree in Economics from the University of North Carolina at Chapel Hill. Not only is JP a commercial real estate market expert and respected independent financial services strategist, but he’s also a US Army veteran and father of five. JP’s professional background is in interest rate derivatives aimed primarily at commercial and multifamily real estate. He works with brokers and borrowers looking at financing and wanting to manage their interest rate exposure on hedging strategies, which usually involve caps, swaps, and defeasances. SPI last interviewed JP in 2022 when the Federal Reserve first began hiking interest rates.

On March 22nd, SPI Co-Founder and Principal Michael Becker (“MB”) sat down with JP to catch up and gain insight into his takeaways from the recent Federal Reserve meeting on March 20th and learn more about how he predicts this will impact the current and near-future state of capital markets.

MB: "JP, what's on your mind following the recent Fed meeting?"

JP: “The most important takeaway from the recent Fed meeting was confirmation that interest rate cuts will start this year… [Jerome] Powell drove home that The Fed decided to overlook January and February’s high inflation data. Interestingly enough, February's inflation data wasn't nearly as bad as January's, which makes January feel like even more of an outlier. And, if you go back to last year, the same thing played out – January and February signaled high inflation, then it came down considerably throughout the rest of the year. I think the previous two months of data certainly put them on alert, but essentially they said, 'Let's just see how March and April play out,' therefore their plan to cut rates hasn’t changed. If this data didn't spook them to the point where they felt they needed to take rate cuts off the table, I'm not sure much will… So, this has allowed the market to exhale and say, 'Okay, we're on a good trajectory here. We will see cuts coming this year, no matter what.' I think the three cuts Powell promised is a reasonable number to expect. We should expect them sooner rather than later.”

“The most important takeaway from the recent fed meeting was…

…CONFIRMATION THAT INTEREST RATE CUTS WILL START THIS YEAR."

MB: "What is your response to people saying that The Fed is not going to cut this year because inflation hasn’t come down as much as they want?"

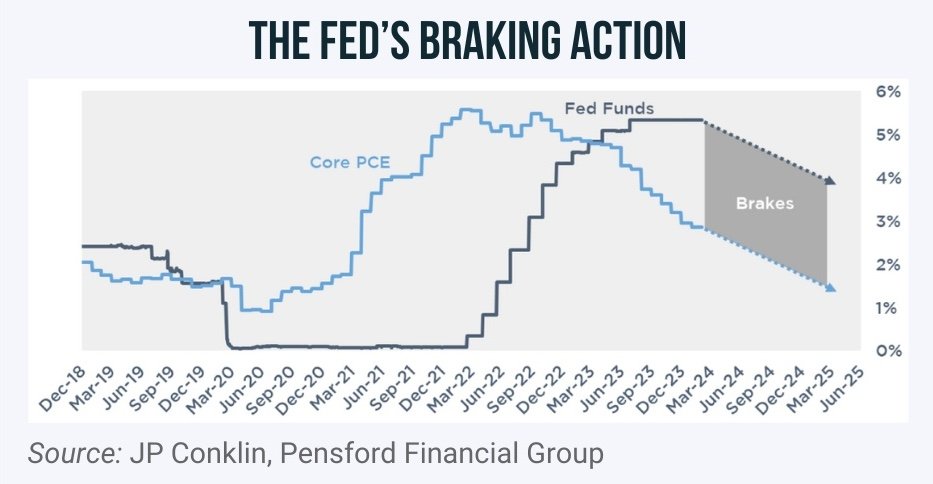

JP: “It is just not true. The Fed can ride inflation down and still apply the same amount of braking action. Powell said we are in 'sufficiently restrictive territory.' So, they will cut rates to ensure not to 'apply the brakes' too hard. It doesn't mean that they're pushing on the gas pedal, just that they're easing off the brake to touch – that's it. And we will likely have positive rates for years, which is still braking action. The Fed knows that if they keep rates at current levels, they risk 'slamming on the brakes' and the economy coming to a dead stop.”

MB: “Should we rely specifically on three cuts in 2024? Or, do you expect more or less?”

JP: “I think it will end up being more than three, but three is a reasonable number. If I were setting the 'over-under,' I would probably wager at three and a half; however, because the Fed has historically underestimated the amount of cuts, I think it could be as many as five. However, from now until the end of 2025, I expect around six to eight total.”

MB: “Are there any factors that could considerably impact the number of expected cuts?”

JP: “My biggest concern regarding the number of cuts we can expect The Fed to make this year relates to the labor market… According to their index, the labor market appears as if it is doing well – three million jobs were added last year, unemployment is still below 4%, and job openings are twice the number of unemployed Americans. However, the numbers in the labor market are not as strong as they suggest, especially when you dig into the composition of the quality of job gains. Moreover, once the labor market breaks, it breaks very quickly – It is a nonlinear event that our brains are not equipped to handle…We can go from 4% to 5% to 6% unemployment rapidly, and no one is pricing for that outcome. Everyone believes, 'Oh, it will be this slow, gradual climb in unemployment rate.' Well, it has never done that before, so why do we assume that is what will happen this time? Powell repeatedly stated that while we are not currently seeing signs of this, any unexpected weakening of the labor market would cause us to cut sooner and/or more than expected… The fact he went out of his way to bring this up indicates that it is something they’re monitoring more closely. Because they underestimate the number of cuts in addition to their prediction that we end 2024 with unemployment at 4.0-4.1% and we’re already currently at 3.9%, I think it is reasonable to project around four or five cuts. Only time will tell.”

MB: “When do you foresee the first cut?”

JP: “I am confident June is when we will see the first cut. A year ago, the market was pricing in a near 100% chance of a cut at this recent meeting; however, I have been on the 'June train' for a while and for a couple of reasons… First of all, it seems as if the market has given The Fed permission to delay cuts as long as possible, so even if they could cut in March, why would they? Secondly, even though every meeting is technically considered 'live' these days because they hold a press conference following, they tend to enact significant policy shifts at the 'on' meetings, in which they update the forecast. That happens every other meeting; June is one of those meetings… It just feels more likely that such a monumental shift will also be paired with an update to their economic projections. Additionally, they cannot wait too long due to the optics of interfering with the election. They think, 'We have to set this in motion before too long,' and June seems like the most reasonable time to do so.”

“…june is when we will see the first cut…”

MB: “If we do see the first cut in June, what do you predict the schedule of cuts to follow from then to the end of the year?”

JP: “I could see them arguing that, following the first cut, additional cuts will be on 'autopilot' again aligning with the philosophy of 'setting this in motion.' If they were to cut every meeting consecutively from June through year-end, that would be five. I could also see an argument for cutting every other meeting, which would be three, and result in us being 75 basis points lower at year-end.”

MB: “Interest rates are currently resting around 5.25-5.50%. With cuts expected to start in June, where do you foresee them landing by the end of 2024? 2025?”

JP: “I think we will end this year around 4.25-4.50%. Essentially, one point lower than where we are now. By the end of 2025, I think we will probably land at around 3.50%.”

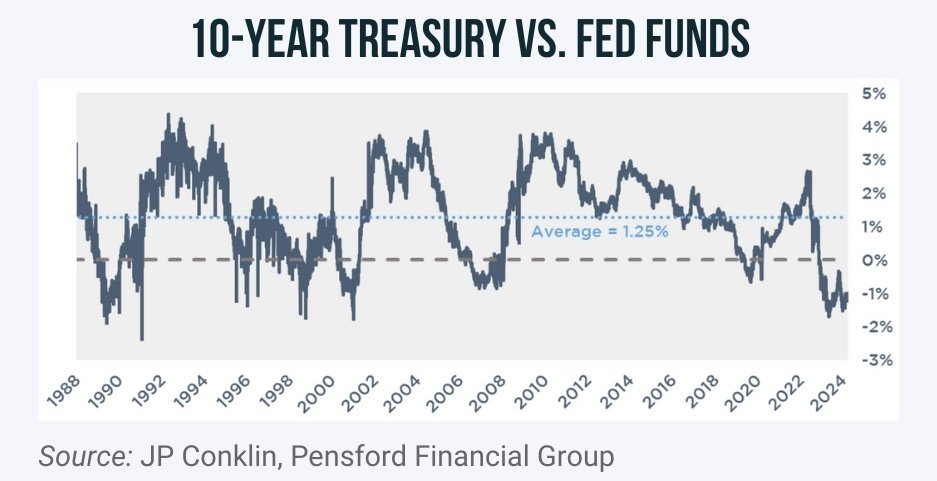

MB: “What about for the 10-Year Treasury?”

JP: “It just depends on the economy. If we experience a mild slowdown, I do not know that it arrives at anything below 3.50%. The historical spread between Fed funds and the 10-Year Treasury is around 1.25%. So, if we think Fed funds will end up at 3.25-3.50%, 3.75% is not an unreasonable 10-Year Treasury to expect. If I were a fixed rate borrower, I would be cautious in thinking that the 10-year will land around 3.00%. I am not confident that is likely, absent the economy slowing dramatically.”

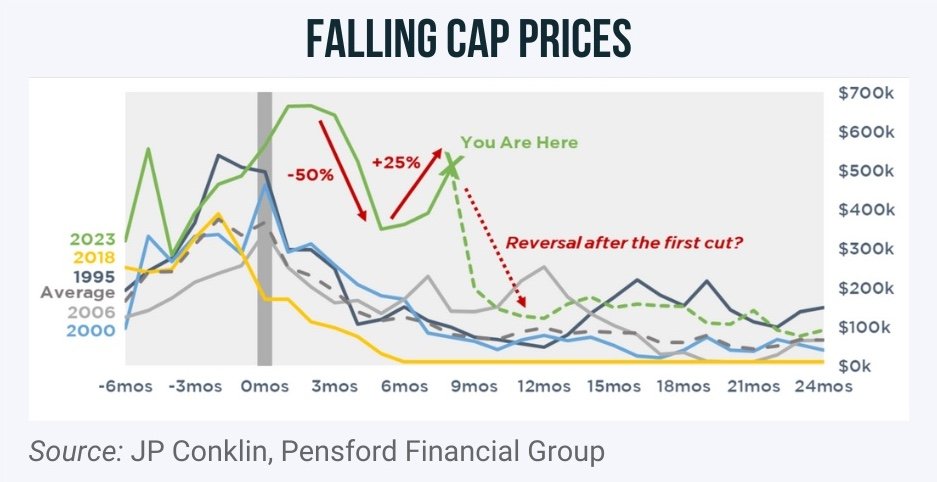

MB: “What are your thoughts on how cap prices will be impacted once rate cuts begin? And, have we seen any reaction from the recent decision?”

JP: “Minimal. From March of 2022 until now, it has been a roller coaster. The recent peak in cap costs was at the end of October 2023, following the first pause from The Fed’s series of hikes. In December of 2023 and January of this year, once it was clear additional hikes were unlikely, we saw a plunge in cap prices; however, they have since rebounded about 25%...Once we get the first cut and we can measure its quantity, I expect to see cap costs come down again.”

MB: “What is your advice to a borrower projecting to purchase a cap in July? Would you suggest buying a one-year cap? Or, a two-year?”

JP: “If I have to buy a cap in July, I would say, 'I am holding off.' I think it is highly likely that The Fed will be cutting rates by that time frame. Your risk in that scenario is either after the first cut The Fed says 'You know what? We are cutting once, but not three.' At that point, you might as well just wait and see what happens.

With what we know right now, I would purchase a one-year cap because I think they will end up cutting more than it is priced in next year. The Fed’s been hiking for two years, and Fed funds have been over 5% for a much shorter time than we have been applying the brakes on the economy…It seems like it has not hit the system yet – People are very optimistic right now, even though they have not dealt with these interest rate levels for too long. I believe they will cut more than expected in 2025, so I would hold off on purchasing a two-year cap. It might be 50% less expensive if you can wait another year.”

“I WOULD HOLD OFF ON PURCHASING A TWO-YEAR CAP…

…it might be 50% less expensive if you can wait another year.”

MB: “What about in December?”

JP: “I would still wait because we will continue to see the economy slow. By December, we will be on the far side of the election, and I think that The Fed will be willing to be more proactive about cuts at that point than they will be before the election. So, I can envision a scenario where year-end 2025 is identical, regardless of how many cuts they make this year – they will just make up for it next year. So, if they do fewer cuts this year, we should expect more next year. If they enact five cuts this year, it should be relatively level in terms of cuts next year. Once we pass the election, The Fed will be more willing to cut aggressively and say, 'You know what? The President has been decided. We can go back to work and get more aggressive if needed.'"

MB: “Do you think there is a possibility that we see inflation re-accelerate?”

JP: “It is possible. I could see inflation leveling off higher than we experienced for the last 10 years; however, I am not too concerned about it just re-accelerating. Maybe it will land around 2.5% to 3.0% instead of The Fed’s target of 2.0%. The wheels are not falling off the economy at that level. So, it is not going back to 5.0% or 6.0%.”

MB: “How do you expect fluctuations in the 10-Year Treasury rate to impact borrowers?”

JP: “We strongly suggest to our fixed rate borrowers that 10- and 5-Year Treasuries always move before The Fed and then wait for The Fed to catch up. So, when a borrower sees a point drop in the 10-Year Treasury, that is their window to execute because now it is just a waiting game. Rates recalibrate based on its changing expectations for Fed policy. When the Fed does start cutting, do not expect another one-for-one drop from here – The move has already happened, and now it is just waiting to catch up. A 10-Year Treasury rate of 4.25-4.30% is probably too high. I think right now, 4%-ish probably feels nice. I would not be surprised if the economic data continues to weaken like I think it will, and I would not be surprised to see it run to 3.5%, but 3.0% feels unrealistic with where we are today. 3.0% on the 10-year Treasury only happens if the wheels fall off of the economy in the next year or so. If that happens, then the 10-Year will absolutely fall further.”

MB: “Say you see the 10-Year Treasury hovering around 3.5%, do you see that as a good opportunity to convert a floating rate loan to a fixed?”

JP: “Absolutely, yeah. The only reason I would not in that scenario is if it is obvious the wheels are falling off the economy, and therefore, The Fed will have to cut way more than we currently think. If three cuts become ten, you do not need to lock. Your floating rate is about to come screaming down.”

MB: “What do you consider a good indicator that the ‘wheels are falling off the economy’?”

JP: “Typically the best indicator is that unemployment is surging. If it is clear we are losing jobs each month, that would be, to me, the clearest indication.”

MB: “Do you foresee the election impacting interest rates?”

JP: “Historical trends suggest that 90 days after the election overall, interest rates are unchanged, regardless of who wins. There tends to be a one-month bump when a Republican wins, and it pops 20-25 basis points, but it then quickly diminishes, and we are back to identical rates within those 90 days. Essentially, the election does not significantly impact interest rates, so I do not put too much stock in it. What I do think it will have an impact on is transactions in the second half of this year. People tend to go into 'wait and see' mode during an election year because they just want to know what rules to adhere to.”

“90 DAYS AFTER THE ELECTION…

…Interest rates are unchanged, regardless of who wins.”

MB: “Do you expect transaction volume to slow as we near the election? If so, by how much?”

JP: “Yes, definitely. In 2012, our transaction volume plunged to zero. Around July/August or September, I had lunch with a client and asked him, 'Obama has already been in office. Why are people this nervous about him getting reelected?' He responded, 'It's not that...We just need to know what rules to play by.' A presidential election is certainly a threat to the rules. My client continued, 'Once we get on the other side of this election, it does not matter who wins. We will all go back to business.' And he was right – We took off for the next three years. However, I think we will see the acceleration of transactions due to rates coming down, but it will be dampened because of the offsetting counter-effect of an election. Then, I think in 2025, it will be 'off to the races.'

“in 2025, it will be ‘off to the races’”